Biden's Tax Proposal: Experts Warn of Economic Harm

- April 26, 2024 10:00am

- 257

President Biden's proposal to increase the top capital gains tax rate to 44.6% has drawn criticism from experts, who warn that such a tax hike could significantly harm the U.S. economy by discouraging investment and slowing economic growth.

President Biden's latest proposal to hike the top capital gains tax rate to its highest level in more than a century is facing heavy criticism from experts who warn such an action could significantly harm the U.S. economy.

According to a report issued by the Treasury Department, led by Secretary Janet Yellen, the president's proposed fiscal year 2025 budget would increase the top marginal rate on long-term capital gains and qualified dividends to a staggering 44.6%. A capital gains tax hike of that magnitude would take the rate to its highest level since it was first introduced in the early 1920s.

Experts argue that such a tax hike would have detrimental consequences for the economy.

"Investment is the real driver of economic growth," said E.J. Antoni, an economist and research fellow at The Heritage Foundation. "Investment is what gives you productivity gains. Investment is where you get factories and machines — it's where businesses are able to provide their workers with tools and equipment that allow them to increase their productivity, to increase wages, etc."

Antoni warns that "if you're going to tax something, you get less of it," and that this applies equally to investment. "Taxing capital gains means less investment, it means less economic growth, and it means the rise in people's standards of living is going to slow dramatically."

The Treasury Department's report states that the 44.6% rate is a combination of proposals, including increasing the top ordinary capital gains rate from 20% to 37%. The bulk of the tax hikes impact Americans with taxable income greater than $1 million.

However, Antoni argues that the economic impacts of such a tax hike would be broad. He points out that inflation impacts the price of equities, such as stocks, meaning that a tax on gains when equities are sold also taxes inflation.

Increasing capital gains taxes, therefore, could create a larger incentive for lawmakers and federal policymakers to maintain high rates of inflation to guarantee larger tax revenues.

Mike Palicz, director of federal tax policy at Americans for Tax Reform, echoed Antoni's concerns. "These are the really dangerous Biden proposals that a lot of people miss when it's rolled out from Treasury," Palicz said. "They actually come out and say, 'we're advocating for a top capital gains rate of 44.6%.'"

Palicz emphasized the impact on Americans' savings and investments. "This is people's nest egg. This is them saving, them investing — it's their American dream. And here is Biden coming out with the highest proposed capital gains tax in 100 years."

Americans for Tax Reform has warned that the tax proposal could lead to many Americans paying rates of more than 50% on income, especially when combined with high state taxes. The group also noted the potential impact on small business owners, who would be exposed to the high rate when selling their businesses.

Biden's proposal would further create a mandatory capital gains tax on transferred assets for families when parents pass away.

Additionally, Biden's proposal would impose a 25% tax on unrealized capital gains owned by Americans whose wealth exceeds $100 million. Overall, that new tax, along with the substantial capital gains tax increase, are projected to lead to nearly $800 billion in new government revenue, according to a Peter G. Peterson Foundation analysis.

Antoni expressed skepticism about the revenue projections, arguing that they are based on the assumption that people will not change their behavior in response to the higher tax rates.

"The idea that this is somehow going to raise trillions upon trillions of dollars is once again based on the notion that people will respond by essentially not responding," Antoni said. "In other words, I won't actually change my behavior when faced with these higher tax rates."

In conclusion, President Biden's proposed tax hike on capital gains has drawn widespread criticism from experts, who warn that it could stifle investment, slow economic growth, and ultimately harm the American Dream.

Related articles

-

Obama Expresses Concerns about Biden's Re-election Chances

Former President Barack Obama reportedly worries about President Biden's ability to secure a second term, despite publicly stating his unwavering...

Obama Expresses Concerns about Biden's Re-election Chances

Former President Barack Obama reportedly worries about President Biden's ability to secure a second term, despite publicly stating his unwavering...

- 03 Jul 2024

-

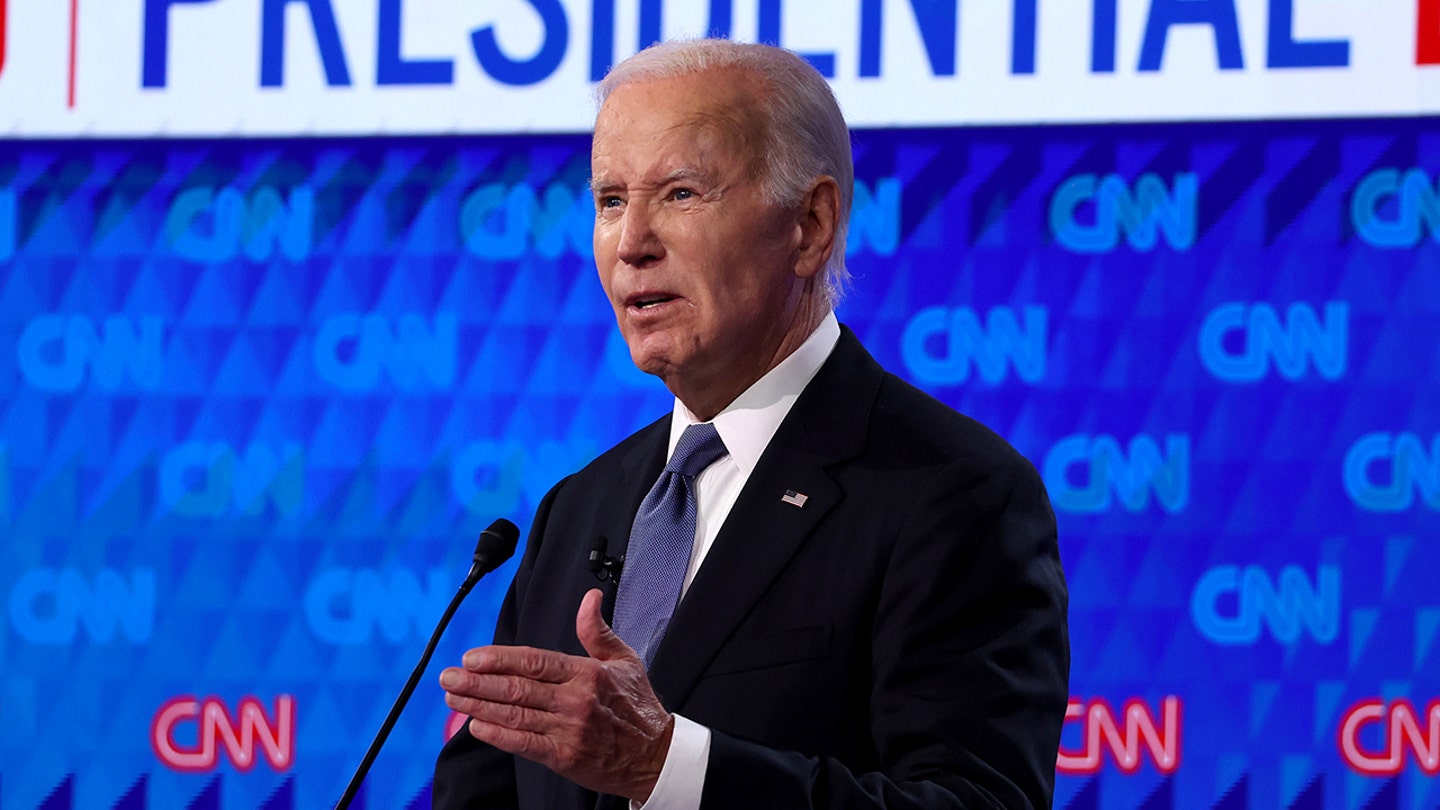

Biden Admits to Rocky Debate Performance, Blames Europe Trips

President Biden has acknowledged having a "bad night" at the recent presidential debate, attributing his performance to a series of trips to Europe...

Biden Admits to Rocky Debate Performance, Blames Europe Trips

President Biden has acknowledged having a "bad night" at the recent presidential debate, attributing his performance to a series of trips to Europe...

- 03 Jul 2024

-

Former White House Press Secretary Jen Psaki to Testify on Afghanistan Withdrawal

Former White House press secretary Jen Psaki has agreed to sit down with House GOP investigators probing the Biden administration's withdrawal from...

Former White House Press Secretary Jen Psaki to Testify on Afghanistan Withdrawal

Former White House press secretary Jen Psaki has agreed to sit down with House GOP investigators probing the Biden administration's withdrawal from...

- 03 Jul 2024

-

Jill Biden's Vogue Cover Sparks Controversy Amid Concerns over Joe Biden's Mental Fitness

Vogue's August issue cover featuring First Lady Jill Biden has ignited intense reaction following President Biden's disastrous debate performance....

Jill Biden's Vogue Cover Sparks Controversy Amid Concerns over Joe Biden's Mental Fitness

Vogue's August issue cover featuring First Lady Jill Biden has ignited intense reaction following President Biden's disastrous debate performance....

- 03 Jul 2024

-

Nancy Pelosi Raises Concerns About Biden's Fitness for Office

House Speaker Nancy Pelosi has raised questions about President Biden's mental fitness, suggesting it is legitimate to ask if he has a "condition"...

Nancy Pelosi Raises Concerns About Biden's Fitness for Office

House Speaker Nancy Pelosi has raised questions about President Biden's mental fitness, suggesting it is legitimate to ask if he has a "condition"...

- 03 Jul 2024

-

Stephanopoulos Insists on Grilling Trump About 2020 Election Results During Debate

ABC News anchor George Stephanopoulos urges CNN's Abby Phillip to confront former President Trump about his baseless claims regarding the 2020...

Stephanopoulos Insists on Grilling Trump About 2020 Election Results During Debate

ABC News anchor George Stephanopoulos urges CNN's Abby Phillip to confront former President Trump about his baseless claims regarding the 2020...

- 03 Jul 2024

Leave a comment

Your comment is awaiting moderation. We save your draft here

0 Comments

Chưa có bình luận nào